Condo Insurance in and around Summerville

Looking for excellent condo unitowners insurance in Summerville?

State Farm can help you with condo insurance

- South Carolina

- Lowcountry

- Dorchester County

- Berkeley county

- Charleston County

- North Charleston

- Mount Pleasant

- Nexton

- OAKBROOK

- saint george

- Kiawah

- Isle of Palms

- Columbia

- Morris Island

- Beaufort

- Bluffton

- West Ashley

- Ladson

- Goose Creek

- Daniel Island

- JB Charleston

- windwood

- Hanahan

- Ridgeville

Welcome Home, Condo Owners

Because your unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to smoke or weight of ice. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Looking for excellent condo unitowners insurance in Summerville?

State Farm can help you with condo insurance

Why Condo Owners In Summerville Choose State Farm

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Henry Gordon is ready to help you navigate life’s troubles with reliable coverage for all your condo insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Henry Gordon can help you submit your claim. Keep your condo sweet condo with State Farm!

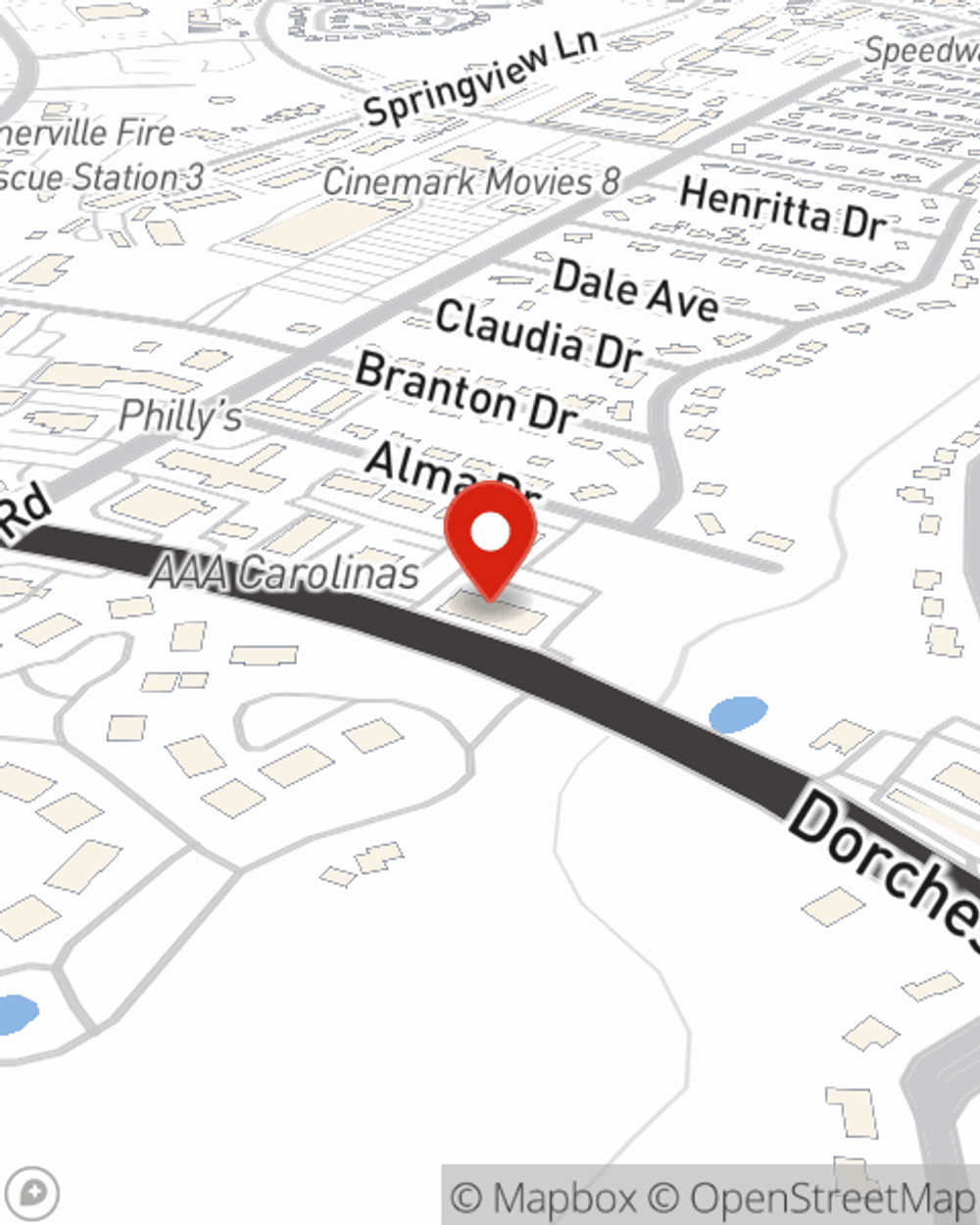

Visit State Farm Agent Henry Gordon today to experience how one of the leading providers of condominium unitowners insurance can help protect your condominium here in Summerville, SC.

Have More Questions About Condo Unitowners Insurance?

Call Henry at (843) 486-2005 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Henry Gordon

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.